If you are active in Micromobility, you would have definitely used one of the Ninebot scooters. In 2018, Segway, which is part of Ninebot hit a jackpot with most, if not all scooter operators buying their slightly modified version of the personal scooter and flooding the streets across the globe.

Last year, Ninebot filed for an IPO on the Shanghai Stock Exchange STAR Market. Though we did not hear much about it, in a recent Micromobility Industries podcast, Tony Ho, the VP of Global Business Development for Segway mentioned about it.

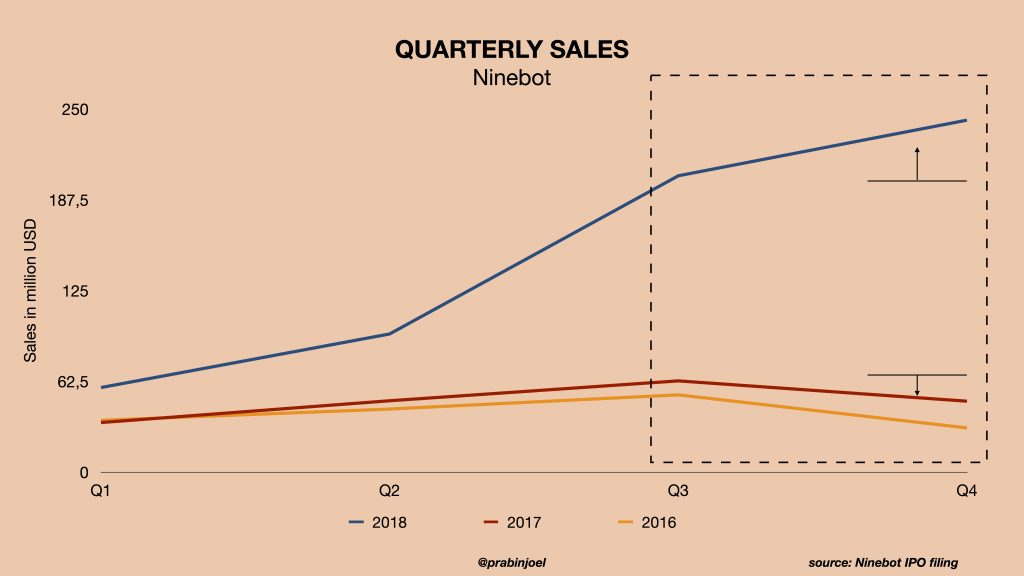

I managed to get a copy of the IPO document and captured few important points summarised below. Most of the data are for the years 2016, 2017 and 2018.

Ninebot, as contrary to the general thought is not registered in China, but in Cayman Islands – established on 10th December 2014. Mr. Gao Lufteng and Mr. Wang Ye are the controllers of the company with 66.75% of the voting rights.

Sequoia Capital is the single largest shareholder (in common stock) with 16.8% of the shares, but 7,83% of the voting rights. Intel holds 3.32% of the company. Interestingly, Sequoia also invested into Bird.

The end user app from Ninebot had 2.8million registered users, excluding shared scooter users, with 400k monthly active users covering 710 million kilometres. Ninebot also collects user data to “better understand customer needs, .. enhance customer experience and stickiness”.

Ninebot sold 1.61 million “Smart Electric Scooters” in 2018 (+576% vs 2017), up from 238k (+1796% vs 2016) in 2017 and 12.5k in 2016. In 2018, the factory utilisation was at 89.09%.

In 2018, Ninebot spent ~$262.5 million on raw materials. Main purchases are,

- Battery – 24.47%

- Hub Motor – 10.3%

- Controller: 4,74%

- Frame: 2,27%

In 2017 Ninebot spent $99.4 million on purchase of raw materials and $86.3 million in 2016. Ninebot also disclosed the average unit price for the main components for a batch of 10k units.

| Component | Unit Cost |

| Battery | $45.3 |

| Hub motor | $19.9 |

| Controller | $11.4 |

| Frame | $13.1 |

Bird and Lime were among the top there customers of Ninebot in 2018, together accounting for ~16% of the Revenues.

| S. No. | Customer | Sales Amount ($m) | % |

| 1 | Xiaomi Group | 343.7 | 57.31% |

| 2 | Bird | 57.8 | 9.65% |

| 3 | Lime | 37 | 6.18% |

| 4 | JD | 14.2 | 2.38% |

| 5 | Hillside | 14 | 2.34% |

As of March 31, 2019, Ninebot and its subsidiaries have, 105 domestic registered trademarks, 223 foreign registered trademarks, 326 domestic patents (36 inventions, 182 utility, 108 design) and 223 foreign patents.

As of December 31, 2018, Ninebot had 1488 employees. The R&D team was 401 people strong, amounting to ~26.9% of the workforce. Ninebot spent $17.3 million on R&D, up 34.8% from 2017 ($12.9million).

As of December 31, 2018 Ninebot subsidiaries Segway Europe had an Operating Income of $36.4 million and Segway US (Delaware) had $23.7 million with a Net Profit of -$341k.

In 2018, Ninebot had a Turn over of $600million and posted a negative Net Profit of $254.1million. Operating income was up 207.5% vs 2017. Here is a snapshot of the income statement: (in $m)

| 2018 | 2017 | 2016 | |

| 1. Operating Income | 599.79 | 195.05 | 162.79 |

| Less: Operating Costs | 426.7 | 148.74 | 113.46 |

| Taxes and surcharges | 1.68 | 1.06 | 0.93 |

| Sales Expense | 26.15 | 17.03 | 12.69 |

| Management Fees | 32.17 | 23.65 | 17.81 |

| R&D Expense | 17.38 | 12.9 | 10.07 |

| Financial expenses | -1.34 | 0.97 | 0.47 |

| Asset Impairment Losses | 7.62 | 1.49 | 2.25 |

| Add: Other income | 2.74 | 2.79 | 0 |

| Investment income | 0.85 | 0.06 | 0.12 |

| Gains from changes in Fair value | -332.23 | -83.13 | -29.88 |

| Asset disposal income | 0.02 | 0 | 0.33 |

| Operating Profit | -239.19 | -91.07 | -24.33 |

| Total Profit | -238.57 | -87.74 | -20.20 |

| Net Profit | -254.07 | -88.57 | -22.25 |

If you look at the Revenues from “Electric Scooters”, in 2018 it was $398.7million (+724.6% vs 2017), $48.3million (+1851.7% vs 2016) in 2017 and $2.47million in 2016. Contribution of electric scooters to the overall turnover –> 2018: 66.46%, 2017: 24.78%, 2016: 1.52%

Ninebot has two sales modes – Distribution and Direct. Assuming that “Direct” is what is sold to scooter sharing companies, in 2018 Ninebot made $146.7million accounting for 24.45% of the turnover. In 2017 it was $3.8 million (~1.96% of TO). Turnover in 2018 from Micromobility cos went up by 3735.2% vs 2017.

Though Ninebot posted negative Net Profit in all the three years reported, the Electric Scooters business saw positive Gross Margins.

| Year | Gross Margin (in $m) | Gross Margin % |

| 2018 | $116.8 | 29.3% |

| 2017 | $7.4 | 15.48% |

| 2016 | $0.377 | 15.24% |

Surprisingly, Ninebot also revealed their unit economics in addition to their unit cost of key components. Total cost of the scooter did not go down over the years.

| 2018 | 2017 | 2016 | |

| Unit Price($/unit) | 247.66 | 203.17 | 197.34 |

| Unit Cost($/unit) | 175.09 | 171.71 | 167.27 |

| Unit Gross Profit ($/unit) | 72.57 | 31.46 | 30.07 |

| Gross Margin % | 29.3% | 15.48% | 15.24% |

Different seasons impacted the revenues of Ninebot, with the exception of 2018. Because of the scooter sharing boom, otherwise down trend Q4 saw an uptick in 2018.

At the end of 2018, Accounts receivable from Scooter sharing companies were, $18.89million from Bird and $1.76million from European scooter operator Voi Technology.

After going through the 500+ page IPO document, I feel that the details exposed are critical info, especially information on their negotiated component costs, unit economics and also the revenue per customer.

Check my tweet thread on this topic:

UPDATE (21/06/2020): Ninebot/Segway filed a new document as they are moving close to the IPO, raising $293 million. Following is a snapshot from the second filing with more numbers from 2019.

- Unit cost of Segway Model Max in 2019 was ~$114.6, down from $175.09 in 2018 (I assume this is for ES4)

- In 2019, Spin (3.18%), Grin (2.8%) and Lyft (2.55%) were among the top 5 customers of Ninebot. Bird and Lime dropped out in 2019, as they moved to OKAI or their own internal Hardware. In 2018 the share of revenues were: Bird (9.65%), Lime (6.18%) and Grin (2.34%).

- How much did scooter companies pay Ninebot in 2019?

- SPIN: $20.9 million

- GRIN: $18.4 million

- LYFT: $16.7 million

- VOI: $16.4 million

- UBER (JUMP): $13.9 million

- Interestingly, Amazon paid $17 million to procure scooters. It is a 17x increase compared to their spending in 2018 (~$1 million) – Assuming all these are personal use scooters and equating Amazons spending as a scale for the sector growth, personal use scooter market in 2019 was 17x more than 2018.

- How well did MM cos negotiate unit price for their scooters in 2019?

- SPIN: $422.48

- GRIN: $252.57

- LYFT: $466.9

- VOI: $347.8

- There are about 25 lawsuits involving sharing cos where Ninebot is named as a party. Most of it is related to accidents.

Here is a tweet thread with the 2020 update: