Originally Published on May 25, 2015

Last couple of years have been very good for Indian e-commerce giants. Their valuations are up Year-on-Year and there is no slowdown in the investment flow, thought they haven’t made any profits yet. You can read the article that I wrote about this new trend in investments and startups to get more idea about what I’m talking about.

The valuations of the e-commerce giants in India are up because of the increasing user base that they have acquired using massive discounts as the bait. Discounts of this scale are possible because of the huge cash flow from the Investment firms. And yes, the e-commerce market is booming.

So, what happens to the physical stores across the country as an effect of this growing e-commerce space? In the coming years, most of the physical stores will shut their shop because they certainly cannot afford to match the discounts that these e-tailers give. This will make all the customers rely only on e-tailers for any purchase.

When this happens, it will be the same time when the Investment firms will push the e-commerce companies to focus on making profits and stop the discounts. By then, they would be sitting on a huge pile of debt and even selling products at MRP(Maximum retail price) wouldn’t help them.

What next? Investment Firms will look for a quick exit, and eventually the valuation of the company goes down. With such huge pile of debt, no fund flow is possible, from investors or Banks.

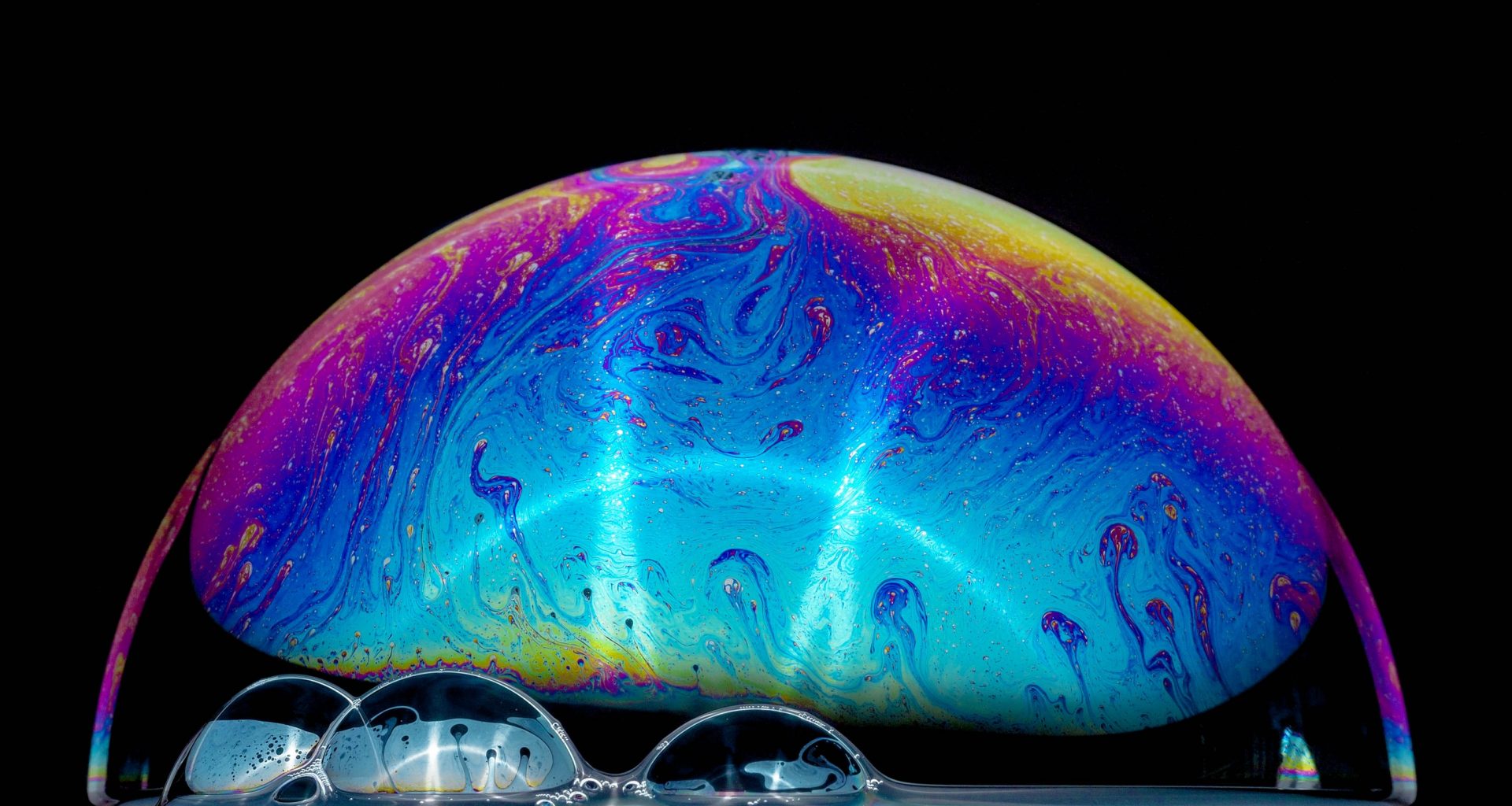

That’s when the Bubble will burst!

Effect of the Bubble burst? Collapse of the e-commerce giants, loss of thousands of jobs & huge loss for the last stage investors.And the worst: No place to go for the consumers to buy things, as by now, all the physical stores would have shut their shops.

I’ll leave the rest to your imagination.